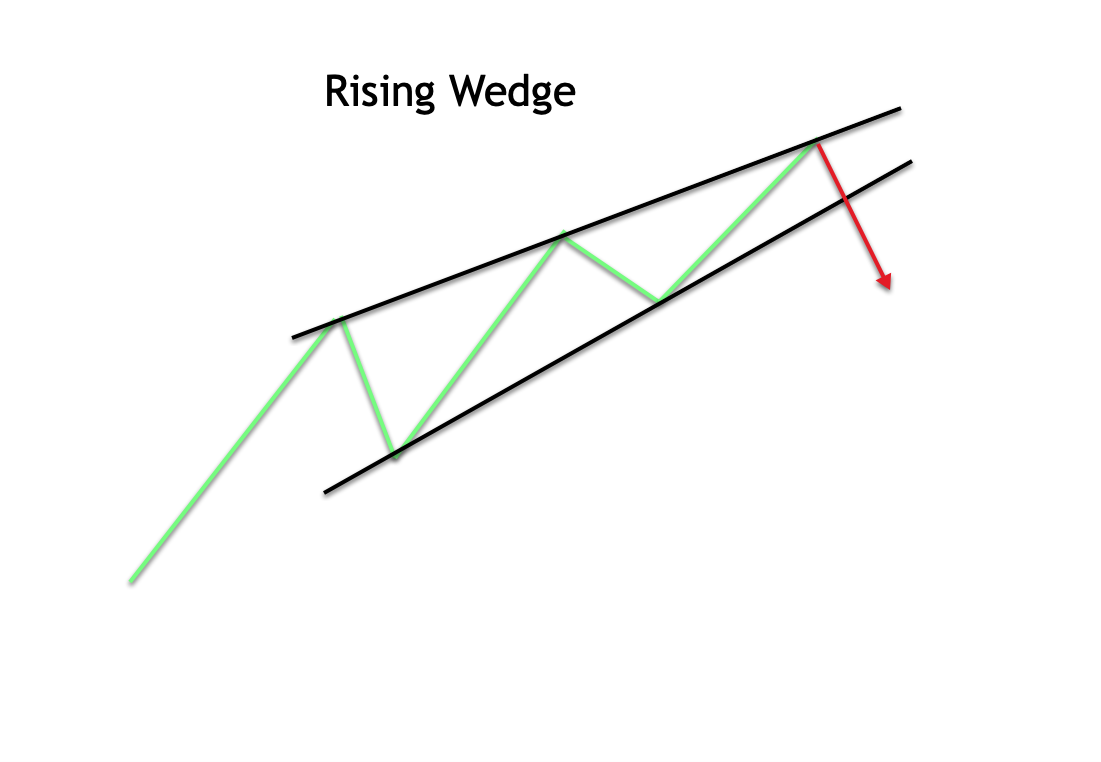

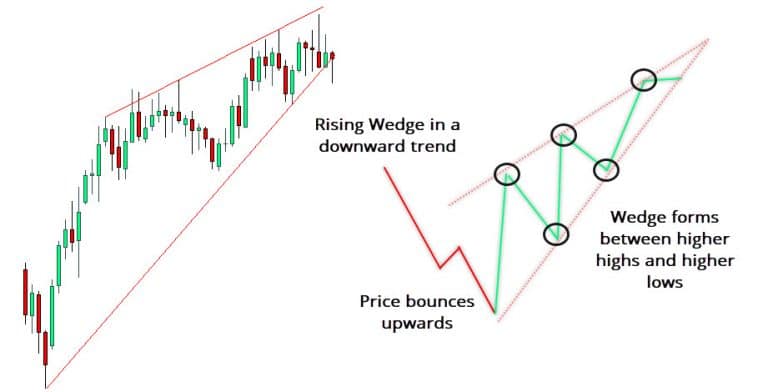

That’s not to say that long-lasting trends won’t turn around. This, in turn, makes it harder for the market to truly reverse. This is because market participants tend to grow accustomed to the direction of the trend, which makes them more eager to buy on dips. In general, a trend that has been ongoing for a long time will be harder to break than one that hasn’t been forming for so long. The preceding trendĪnother thing to remember is that there must be a preceding bullish trend for the pattern to qualify as a reversal pattern. In just a bit you’ll be introduced to a couple of techniques we and other traders use to mitigate this issue! 4. However, one of the most challenging aspects of breakout trading, in general, is to not act on false breakouts, where the market just turns around right after having broken out! Most of those who use breakouts, choose to regard a breakout to the downside as the signal showing that the new bearish phase has begun, or will continue, depending on the preceding trend. As you probably understand, we assume that the breakout will occur in the downward direction, as that would signal that the market is taking off and is headed down. The last part of the rising wedge pattern is the breakout that appears at the end. As such, it’s reasonable to expect that markets stand a higher chance of turning around soon. This simply shows that fewer and fewer market participants are ready to step in as the market gets higher.

VolumeĪccording to the original definition, it’s preferred to see the volume decline as the pattern advances into the wedge.

However, if the resistance line (the upper line) isn’t rising as fast as the support line, it tells us that the bullish forces don’t have quite the strength it takes to push the market to make higher highs, which some choose to regard as a bearish sign. As you might expect, both these lines should be sloping upwards, and converge so that the distance traveled by the market gets smaller and smaller the further it moves into the wedge.Īccording to the original definition of the pattern, you like to see that both lines converge with the same slope. 1.The support and resistance linesĪs the wedge forms, you should be able to draw a resistance line that connects the highs, and a support line that connects the bottoms. Below we have broken down the definition of the pattern, and the various conditions you need to take into consideration. Rising Wedge ExampleĪs to the definition of the pattern, it closely resembles a wedge that has both its lines rising, as you see in the image above. Let’s start! What Is a Rising Wedge? : Definition and meaningĪs said the rising wedge is a bearish pattern that usually signals the end of the current bullish trend, or the continuation of the bearish price moves, depending on the direction of the preceding trend. A short introduction to the falling wedge pattern.How the rising wedge compares to triangles.Some techniques you can use to improve the performance of the pattern, and avoid false breakouts.

#RISING WEDGE PATTERN TARGET HOW TO#

This includes where and how to place the stop loss and profit target Exact rules outlining how many traders choose to trade the pattern.The psychology behind the rising wedge pattern.The exact definition and meaning of the pattern.This article is going to look closer at the rising wedge pattern, and the things you need to know in order to start trading it.

0 kommentar(er)

0 kommentar(er)